Take control of your financial habits

Whether you’re trying to save, plan, or just get a better idea of where your money is going, Midcoast’s “Financial Wellness” tools are the best place to start. Accessed through the “Financial Health” menu in Digital Banking, you can self-manage your spending, budgets, set savings goals, and even take a “Financial Health Assessment” test to get your FinHealth Score®, all from the convenience of your phone or mobile device.

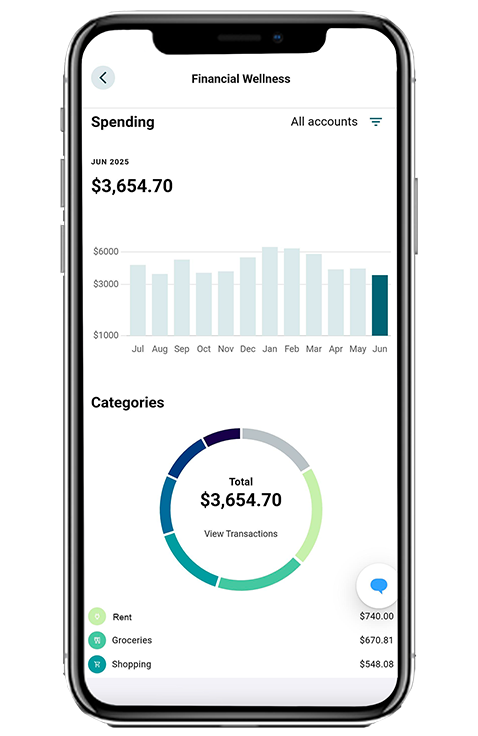

Spending Tracker

Monitor balances and transactions right through your phone, with our Digital Banking!

Wondering where your money is going? Auto-categorize your transactions into groups like rent, groceries, utilities, auto, etc. Or create your own! Chart your spending trends on specific categories over time.

Follow these steps to set up Spending Tracker:

Managed right through your phone or desktop device via Digital Banking.

- 1) Click the “… More” icon in the bottom banner to display the menu.

- 2) Select “Financial Wellness” from the “Financial Health” section of the menu.

- 3) Under the Spending tab, you will see a monthly spend bar chart, and a wheel chart broken out by “categories.”

- 3) To start, click “View Transactions.” You can set categories by clicking the transaction in question, or to edit multiple transactions click “Bulk Edit” at the top left of the list..

- 4) You can view categories for your spending for the current month, to view a previous month’s spending, click on the bar above that month. To view your spending year to date, click the current bar again.

It’s that easy! If you need assistance, feel free to contact us!

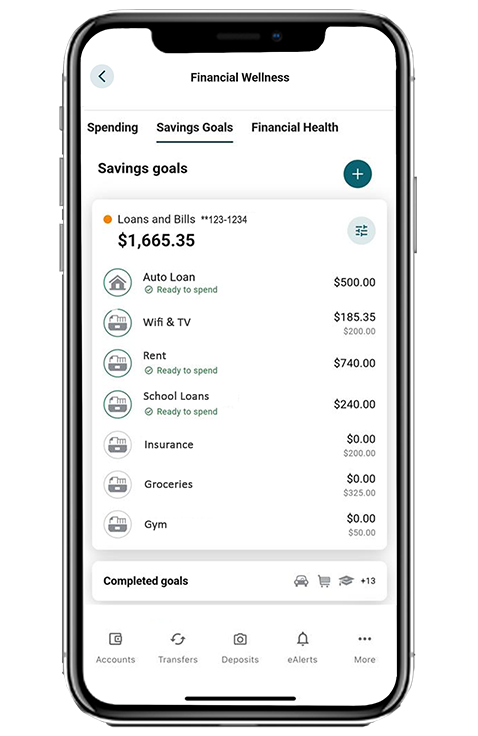

Savings Goals

Saving can be simple with our Digital Banking!

Saving for things like your annual vacation, taxes, holiday gift giving, etc. are easy when you plan ahead. Saving small amounts weekly add up and can help make spending the funds more enjoyable. With the “Savings Goals” feature in Digital Banking, you can move money as often as you’d like with just a few clicks!

Follow these steps to set Savings Goals:

Managed right through your phone or desktop device via Digital Banking.

- 1) Click the “… More” icon in the bottom banner to display the menu.

- 2) Select “Financial Wellness” from the “Financial Health” section of the menu.

- 3) Select to view the “Savings Goals” tab in the banner header

- 4) Next, click the “+” button in the top right-hand corner, then select your preferred savings account you’d like to use, and click “next.”

- 5) Next, choose a category for your goal. (Auto Purchase, Bills and Taxes, Emergency Savings, Trip/Vacation, etc.) and click “next.”

- 6) Next, provide a title, goal amount, and if applicable, a target date (format MM/DD/YYYY) for your goal, (School Loan, Car Payment, Vacation, etc.) then click “create goal“

It’s that easy! You can add money and view the goal status at any time! If you need assistance, feel free to contact us!

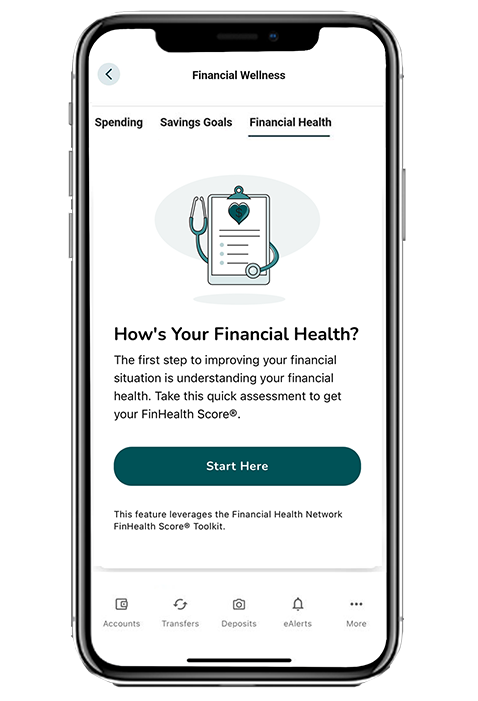

Financial Health Test

What’s your FinHealth Score®? Take the Financial Health Assessment test in our Digital Banking!

Are you overspending? Do you have enough saved for an emergency? The first step to improving your financial situation is understanding your financial health. Take a quick quiz to see if you’re on track, or if you need to make a few adjustments to your saving, borrowing, spending and planning habits?

Follow these steps to take the Financial Health Assessment:

Managed right through your phone or desktop device via your Digital Banking.

- 1) Click the “… More” icon in the bottom banner to display the menu.

- 2) Select “Financial Wellness” from the “Financial Health” section of the menu.

- 3) Select to view the “Financial Health” tab in the banner header.

- 4) Click the “Start Here” button to begin the test.

- 5) There are 8 questions to answer. Click the most applicable answer for your household.

- 6) At the end, you’ll receive a score to determine if you’re “Financially Vulnerable, Financially Coping, or Financially Healthy.” You will also be provided with tips to improve your score in the future. You can return to take the test again at any time.

It’s that easy! If you’d like to discuss your financial health further, set up an appointment to talk with one of our Certified Credit Union Financial Counselors (CCUFC). They are here to help you succeed. It is FREE for any Midcoast FCU member. Learn more about Finacial Counseling