April is Youth Month

April is Youth Month! Midcoast is a great place to open their first account! It all starts with just a $5.00 deposit!

Enroll in eStatements for a chance to win $100! Starting in May, we will randomly select one enrolled user per month through December 2024.

April is Youth Month! Midcoast is a great place to open their first account! It all starts with just a $5.00 deposit!

Spring is a great time to plant your savings! Save for the short or long-term. Lock in a great rate with one of Midcoast's Share Certificate special offers!

(Burger and Bean Soup) On the first Friday of every month, our employees volunteer their time to prepare meals for the Freeport Community Services "First Friday Free Lunch Program." (This recipe comes from our very own Lori M! She was chef for the day! ) The meals are so delicious, that we often receive requests for the recipes. Please enjoy!

(Chili & Cornbread) On the first Friday of every month, our very own Chandra T volunteers her time to prepare meals for the Freeport Community Services "First Friday Free Lunch Program." Her meals are so delicious, that we often receive requests for her recipes. Please enjoy!

Save for the short or long-term. Lock in a great rate with Midcoast's Winter Share Certificate Specials! Expires February 29, 2024

Join us for our Annual Meeting

Make your wish come true! Winter Wish Loans are now available up to $5,000! Offer Expires December 31, 2023.

Fall Share Certificate Special offers! Expires December 31, 2023.

Increased Fraud and Midcoast FCU Phone Number Spoofing Notification

One of the Best Places to Work in Maine for 8 years running!

(Sausage, Kale & Potato Soup) On the first Friday of every month, our very own Chandra T volunteers her time to prepare meals for the Freeport Community Services "First Friday Free Lunch Program." Her meals are so delicious, that we often receive requests for her recipes. Please enjoy!

Frequently Asked Questions about our credit card conversion upgrade.

(Chicken & Sausage Jambalaya) On the first Friday of every month, our very own Chandra T volunteers her time to prepare meals for the Freeport Community Services "First Friday Free Lunch Program." Her meals are so delicious, that we often receive requests for her recipes. Please enjoy!

We are committed to providing our members with highly competitive deposit and loan rates, low-cost financial services, and the latest technology tools to support your financial success! Call, Chat, or stop by one of our five local branches. We are here to help find solutions that will make managing your money easier and more convenient.

We have a team of Certified Credit Union Financial Counselors (CCUFC) that are available by appointment to all Midcoast Members.

(Beef & Vegetable Noodle Soup) On the first Friday of every month, our very own Chandra T volunteers her time to prepare meals for the Freeport Community Services "First Friday Free Lunch Program." Her meals are so delicious, that we often receive requests for her recipes. Please enjoy!

Finance your next vehicle with Midcoast FCU right at the dealership!

Take a break from your monthly loan payment any time of the year with our Skip-A-Pay program.

Looking for your perfect vehicle? Our free Auto Finder can help!

Get your young savers started with an account of their own.

Apply today with great low rates, and easy online applications!

What do the circles and new design colors represent?

(Mexican Style Chicken & Rice ) On the first Friday of every month, our very own Chandra T volunteers her time to prepare meals for the Freeport Community Services "First Friday Free Lunch Program." Her meals are so delicious, that we often receive requests for her recipes. Please enjoy!

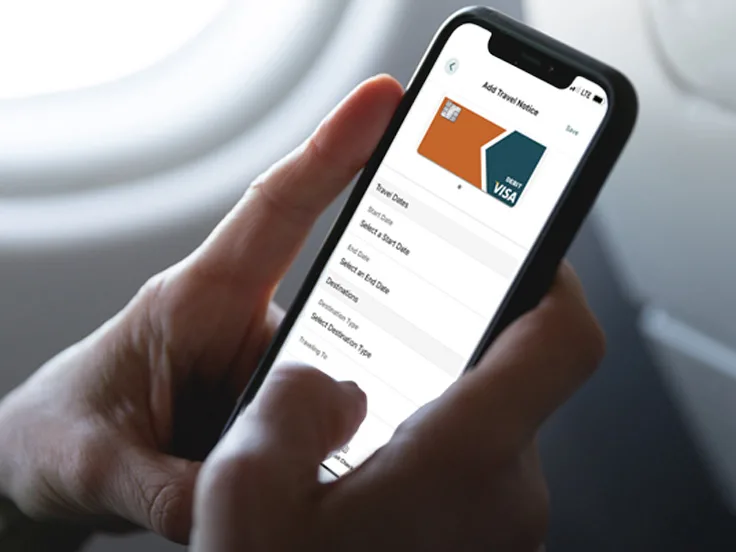

Avoid declined transactions when you travel. Set up your Travel Notice with pre-approved dates and destinations right through Digital Banking.

(Easy & Economic Salmon Burgers) On the first Friday of every month, our very own Chandra T volunteers her time to prepare meals for the Freeport Community Services "First Friday Free Lunch Program." Her meals are so delicious, that we often receive requests for her recipes. Please enjoy!

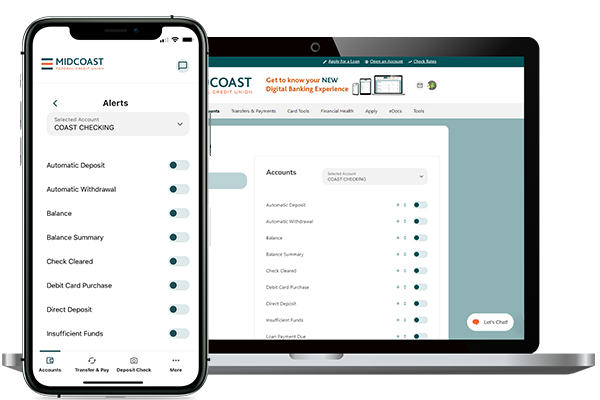

Our new digital banking application has added features to protect your personal and financial information.

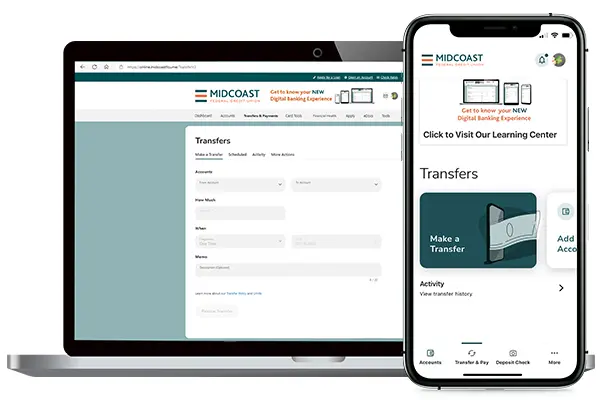

Transfer money with ease between your accounts, to other Midcoast accounts, or to other external accounts you manage.

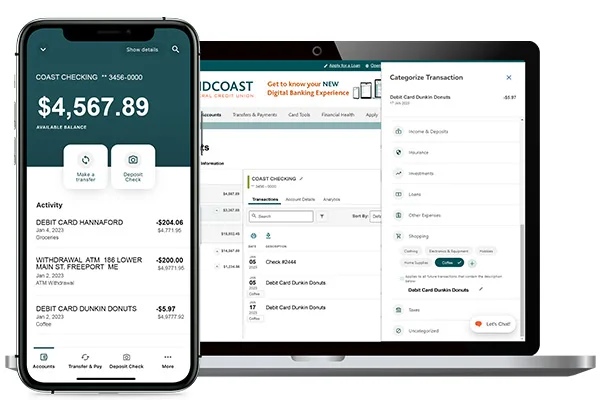

Organize your account transactions however it suits you. Add Transaction Memos and set up Categories to help quickly identify purchases and deposits for future reference.

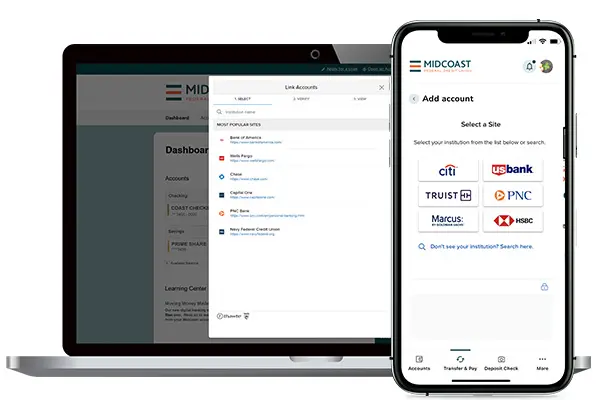

External Account Aggregation lets you link your accounts from other financial institutions to manage all of your finances in one safe, secure place! Follow the steps below to get started.

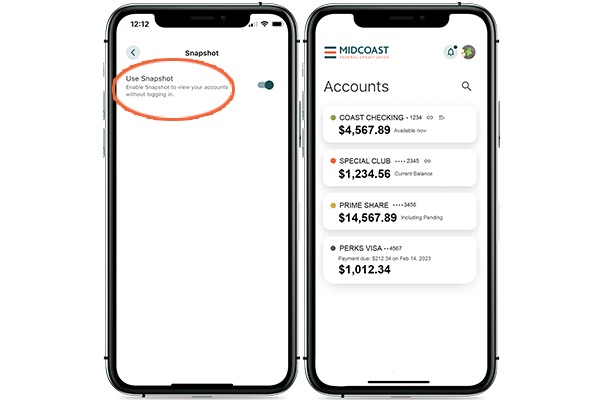

View account balances in an instant, without having to log in.

Frequently Asked Questions about our Digital Banking platform upgrade.

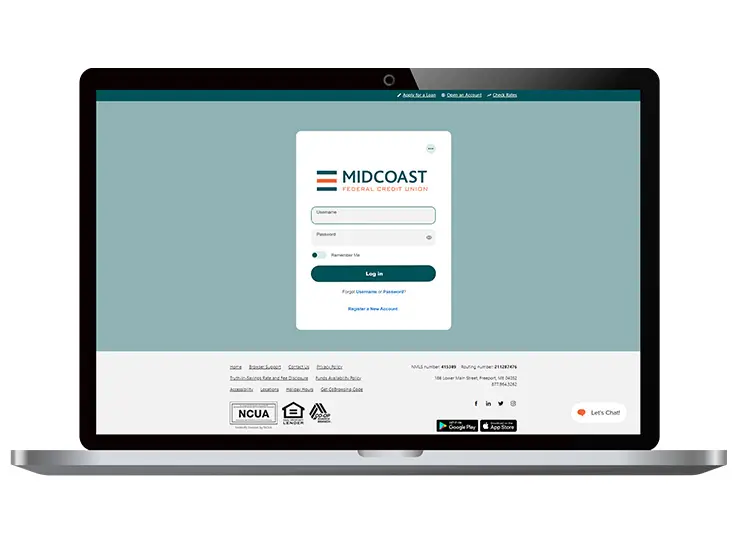

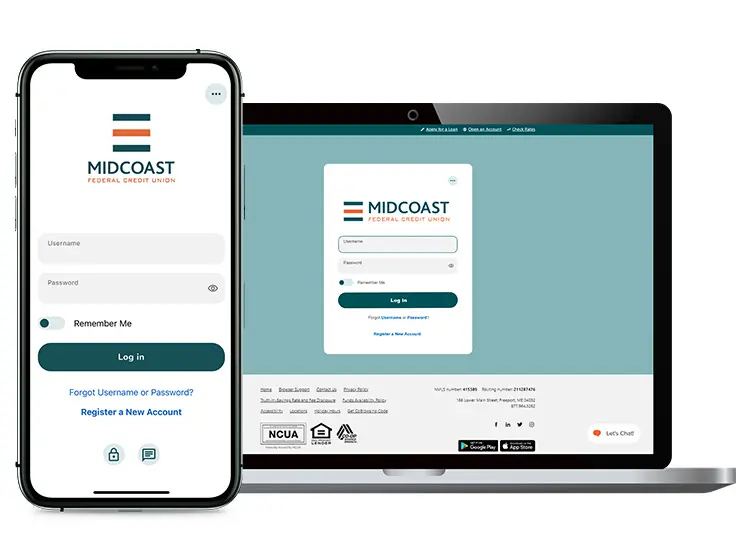

Step-by-step instructions for logging into our Digital Banking platform.

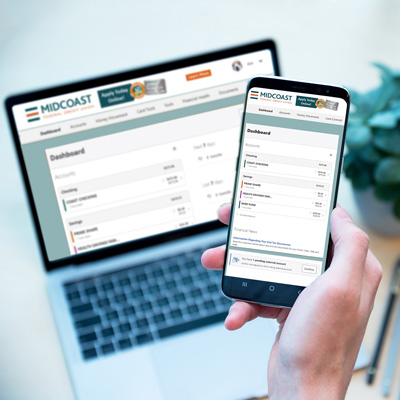

Our digital banking experience offers enhanced features, heightened security, and optimized ease of use. Available for all devices!

(Meatballs) On the first Friday of every month, our very own Chandra T volunteers her time to prepare meals for the Freeport Community Services "First Friday Free Lunch Program." Her meals are so delicious, that we often receive requests for her recipes. Please enjoy!

(Curried Chicken, Squash & Potato Soup) On the first Friday of every month, our very own Chandra T volunteers her time to prepare meals for the Freeport Community Services "First Friday Free Lunch Program." Her meals are so delicious, that we often receive requests for her recipes. Please enjoy!

Make payments to your Midcoast loan, mortgage, or Visa credit card from another financial institution. This secure and convenient option is available on our website and accessible from your desktop and mobile devices.

One of the Best Places to Work in Maine for 7 years running!